Earnings Report

Track daily sales, staff payments, and revenue streams in real time with flexible filters and complete transaction detail

The Earnings Report provides a detailed breakdown of daily transactions, giving you complete visibility into your business’s revenue activity for any specific date or range you choose. With the flexible date picker, you can easily select a single day, a week, or even a custom period—instantly revealing all completed transactions within that window.

Beyond just totals, this report lists each transaction separately, showing which reservationist handled it, which products or experiences were purchased, what payment method was used (credit card, cash, check, etc.), as well as associated taxes, processing fees, and net revenue. This detailed view lets you track every payment and refund, making it easy to balance drawers, monitor staff activity, and quickly resolve discrepancies.

Whether you’re managing your daily cash flow, reconciling end-of-shift payments, or identifying trends in staff and payment type performance, the Earnings Report puts actionable financial insights right at your fingertips. Use it in combination with Xola’s other reports for a complete and reliable picture of your business’s financial health.

User Access: Administrator or Accountant roles have access to the Earnings Report in Xola.

To grant access to users, click here.

What's covered in this article:

What You'll Learn From This Report

The Earnings Report offers insights into:

-

Daily Transaction Breakdown: View all transactions recorded on a specific date or within a selected time frame.

-

Reservationist Activity: Analyze the number of transactions processed by each reservationist, aiding in balancing cash drawers.

-

Payment Methods: Filter transactions based on different payment methods to assess revenue streams.

Note: This report is designed for daily transaction tracking and should not be used to determine overall business revenue. For comprehensive revenue analysis, refer to the Analytics Report.

How to Access the Report

To access the Earnings Report:

-

Navigate to your Xola dashboard.

-

Click on the Reports tab.

-

Select Earnings Report from the dropdown menu.

- Use the filters at the top of the report to narrow down your view:

- Date Range: Choose a date range by which to filter.

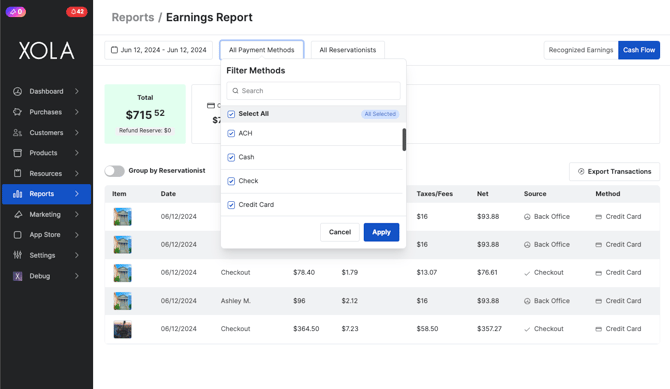

- Payment Methods Filter: Filter transactions based on payment methods (e.g., cash, credit card, other payment methods) to analyze revenue sources. This can be used in conjunction with the Reservationists filter for more detailed insights.

-

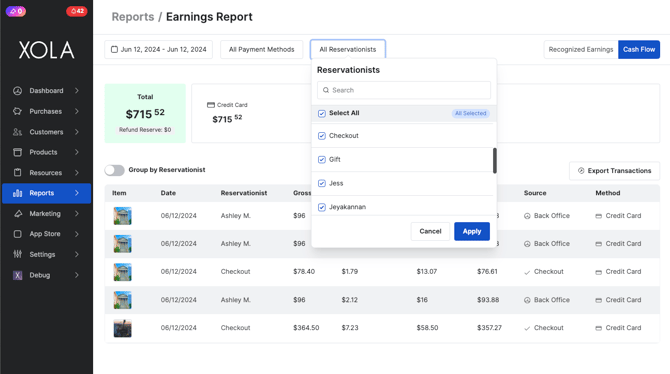

- Reservationists Filter: Use this filter to view transactions processed by individual reservationists within a selected time frame. This is particularly useful for balancing cash drawers at the end of the day.

-

-

Recognized Earnings vs Cash Flow Filter: Use this filter option to toggle between Recognized Earnings and Cash Flow. By default, the Earnings report will always be set to Cash Flow. Here's what each term means:

-

Recognized Earnings: This view shows revenue that has been earned based on when the service (such as a tour or activity) was delivered. It aligns with accrual accounting principles and is helpful when you want to match revenue to the date the experience occurred — not when the payment was received.

-

Cash Flow: This view displays revenue based on when the payment was received, regardless of when the service was provided. It reflects actual money movement in and out of your business, which is useful for tracking daily cash drawer balancing.

-

-

Tip: Use Recognized Earnings when preparing performance or tax reports, and Cash Flow when balancing your books or managing daily finances.

What You’ll See in the Table

At the top of the Earnings Report table, you’ll see a summary bar that displays the total amounts collected by each payment method, such as credit card, cash, check, invoice, and others, for the selected date range.

This gives you a quick, high-level snapshot of how your revenue was received without needing to dig into individual transactions. It’s especially useful for daily reconciliations, spotting payment trends, or verifying cash totals at the end of a shift.

Tip: Use this summary to ensure your on-hand cash and card deposits match what’s expected before closing out the day.

Below the summary bar, the Earnings Report includes a detailed table that breaks down each transaction for the selected date or date range. Here’s what each column represents:

- Item: The name of the tour, activity, or product that was booked or purchased.

-

Date: The date the transaction was processed.

-

Reservationist: The team member who completed the transaction. Useful for evaluating staff activity and balancing individual cash drawers.

-

Gross: The total amount collected before any deductions. This includes the full booking value, taxes, and fees.

-

Processing Fee: The amount deducted by the payment processor (e.g., credit card fees).

-

Taxes/Fees: Any applicable sales tax or additional fees collected during the transaction.

-

Net: The amount you actually take home after processing fees and taxes/fees are deducted from the gross total.

-

Transaction Source: Indicates where the booking originated — such as Checkout, Back Office, OTAs (e.g. Viator, GYG)

-

Method: The form of payment used — e.g., credit card, cash, check.

When you enable the Group by Reservationist toggle above the table, the Earnings Report table reorganizes to show a summary of transactions by each team member. This view helps you quickly understand how much each reservationist collected across various payment methods for the selected time frame.

The table includes the following data points:

-

Name: The reservationist’s name.

-

Credit Card / Cash / Check / Invoice / Other: The total amount processed by that reservationist for each respective payment method.

-

Total: The combined total of all transactions handled by the reservationist across all payment types.

Tip: Use this view at the end of each day to reconcile individual cash drawers or track staff performance in handling payments.

Tip: To print the Earnings Report in a table format, right-click on the screen and select Print.

Exporting the Earnings Report

Use the Export button to export the report to a CSV or Excel file.

Cash Flow Earnings Report

When you export the Cash Flow Earnings Report, the file will include two tabs: Summary and Transactions. Here's what each tab shows:

Summary Tab

The Summary tab gives you a high-level financial breakdown by payment method for the selected date range. This is useful for understanding how different types of payments contribute to your overall earnings.

You’ll see the following columns:

-

Method: The type of payment used (e.g., Credit Card, Cash, Check, Gift Certificate).

-

Gross: The total amount collected for each payment method before any deductions.

-

Processing Fee: The fees charged by payment processors for each method.

-

Service Fee: Any service fees applied to the transactions.

-

Guest Fee: Fees charged per guest, if applicable.

-

Net: The final amount you take home after all fees are subtracted from the gross total.

Tip: This tab is especially helpful for quickly reviewing which payment types are most commonly used and how much they cost your business in fees.

Transactions Tab

This is the most detailed view, listing every transaction included in the report. Columns include:

-

ID: Internal transaction ID.

-

Booking ID: The booking reference number.

-

Confirmation Code: The confirmation number shared with the customer.

-

Transaction Date: When the transaction was processed.

-

Arrival: The date the customer is scheduled to arrive or participate.

-

Realized Date: The date revenue was recognized.

-

Package: If the transaction is part of a package.

-

Item: The product, tour, or activity reserved.

-

Customer Name: Who made the reservation.

-

Currency: The currency used (e.g., USD).

-

Gross: Total amount collected before deductions.

-

Processing Fee: Fee charged by payment processors.

-

Service Fee: Xola’s fee for using the platform, if applicable.

-

Guest Fee: A fee paid by the guest, often retained by your company.

Note: The Guest Fee column will only show for those on the Flex Level.

-

Net: Amount you keep after deductions.

-

Balance: Your running Xola account balance after each transaction.

-

Source: Where the booking originated (e.g., checkout, back office).

-

Method: Payment method used (e.g., Credit Card, Cash).

-

CC Brand: Brand of credit card used (e.g., Visa, Mastercard).

-

Tags: Custom tags you may have applied to purchases or auto tags applied by Xola.

- Payout Date: Date on which the transaction was paid out.

-

Taxes & Fees: Combined total of all taxes and other fees.

-

Each tax and fee will be broken out into the columns following taxes and fees.

-

Tip: Use the Transactions tab for granular reconciliation and the Summary tab for high-level financial reporting.

Recognized Earnings Report

When you export the Recognized Earnings Report, the file will include two tabs: Summary and Transactions. Here's what each tab shows:

Summary Tab

The Summary tab gives you a high-level financial breakdown by payment method for the selected date range. This is useful for understanding how different types of payments contribute to your overall earnings.

You’ll see the following columns:

-

Method: The type of payment used (e.g., Credit Card, Cash, Check, Gift Certificate).

-

Gross: The total amount collected for each payment method before any deductions.

-

Processing Fee: The fees charged by payment processors for each method.

-

Service Fee: Xola’s fee for using the platform is applied to the transactions.

-

Guest Fee: Fees charged per guest, if applicable.

Note: The Guest Fee column will only show for those on the Flex Level.

-

Net: The final amount you take home after all fees are subtracted from the gross total.

Tip: This tab is especially helpful for quickly reviewing which payment types are most commonly used and how much they cost your business in fees.

Transactions Tab

This is the most detailed view, listing every transaction included in the report. Columns include:

- ID: Internal transaction ID.

- Booking ID: The booking reference number.

- Confirmation Code: The confirmation number shared with the customer.

- Transaction Date: When the transaction was processed.

- Arrival: The date the customer is scheduled to arrive or participate.

- Realized Date: The date revenue was recognized, which is after the experience has been completed.

- Item: The product, tour, or activity reserved.

- Package: If the transaction is part of a package.

- Customer Name: Who made the reservation.

- Currency: The currency used (e.g., USD).

- Recognized In Period – Amount of revenue recognized during the report period.

- Previously Collected - Gross – Total amount collected before the report period.

- Previously Collected - Processing Fee – Processing fees collected before the report period.

- Previously Collected - Service Fee – Xola’s fee for using the platform collected before the report period.

- Previously Collected - Net – Net revenue collected before the report period.

- Collected In Period - Gross – Total amount collected during the report period.

- Collected In Period - Processing Fee – Processing fees collected during the report period.

- Collected In Period - Service Fee – Xola’s fee for using the platform collected during the report period.

- Collected In Period - Net – Net revenue collected during the report period.

- Balance: Your running Xola account balance after each transaction.

- Source: Where the booking originated (e.g., checkout, back office).

- Method: Payment method used (e.g., Credit Card, Cash).

- CC Brand: Brand of credit card used (e.g., Visa, Mastercard).

- Tags: Custom tags you may have applied to purchases.

- Taxes & Fees: Combined total of all taxes and other fees.

- Each tax and fee will be broken out into the columns following taxes and fees.

Understanding the difference between collected and recognized revenue is key to interpreting your earnings report accurately. Here’s how they differ in the context of this Xola report:

Collected Revenue

Collected refers to the money you actually received (or was charged to the customer) during the report period — regardless of when the service is delivered.

-

It’s about cash movement, not necessarily when the reservation takes place.

-

You’ll see it split into:

-

Previously Collected: Money received before the report period.

-

Collected In Period: Money received during the report period.

-

Example: If a customer books in March for a tour in April, and pays in March, the payment is “previously collected” in April's report.

Recognized Revenue

Recognized refers to the revenue that is officially counted as “earned” during the report period — based on when the service (like a tour or activity) actually occurs.

-

It’s aligned with service delivery, not payment timing.

-

It reflects earned income for the given month.

Example: That same tour booked and paid for in March, but taking place in April, would be “recognized” in April's report.

Why It Matters

-

You might collect money months in advance (great for cash flow), but you only recognize it as income when the service happens (important for accounting).

-

This split helps with accrual-based accounting, ensuring your financials reflect performance, not just cash flow.